Dreaming of a cozy retreat nestled in the woods? A log cabin home embodies warmth, comfort, and rustic charm. But making this dream a reality requires diligent planning and saving. With the right strategies, you can turn your vision of a log cabin retreat into a tangible goal. Together we’ll explore the step-by-step guide to help you save up for your dream log cabin home.

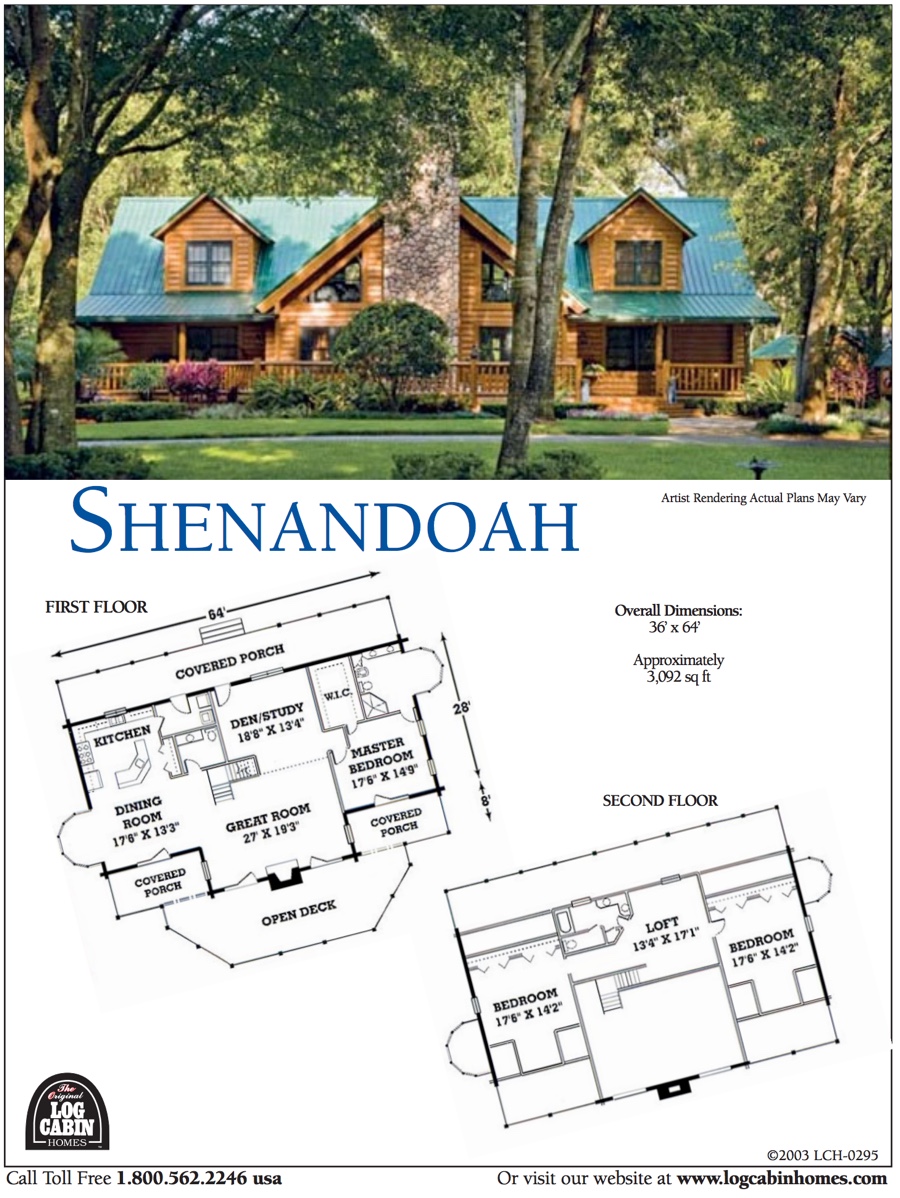

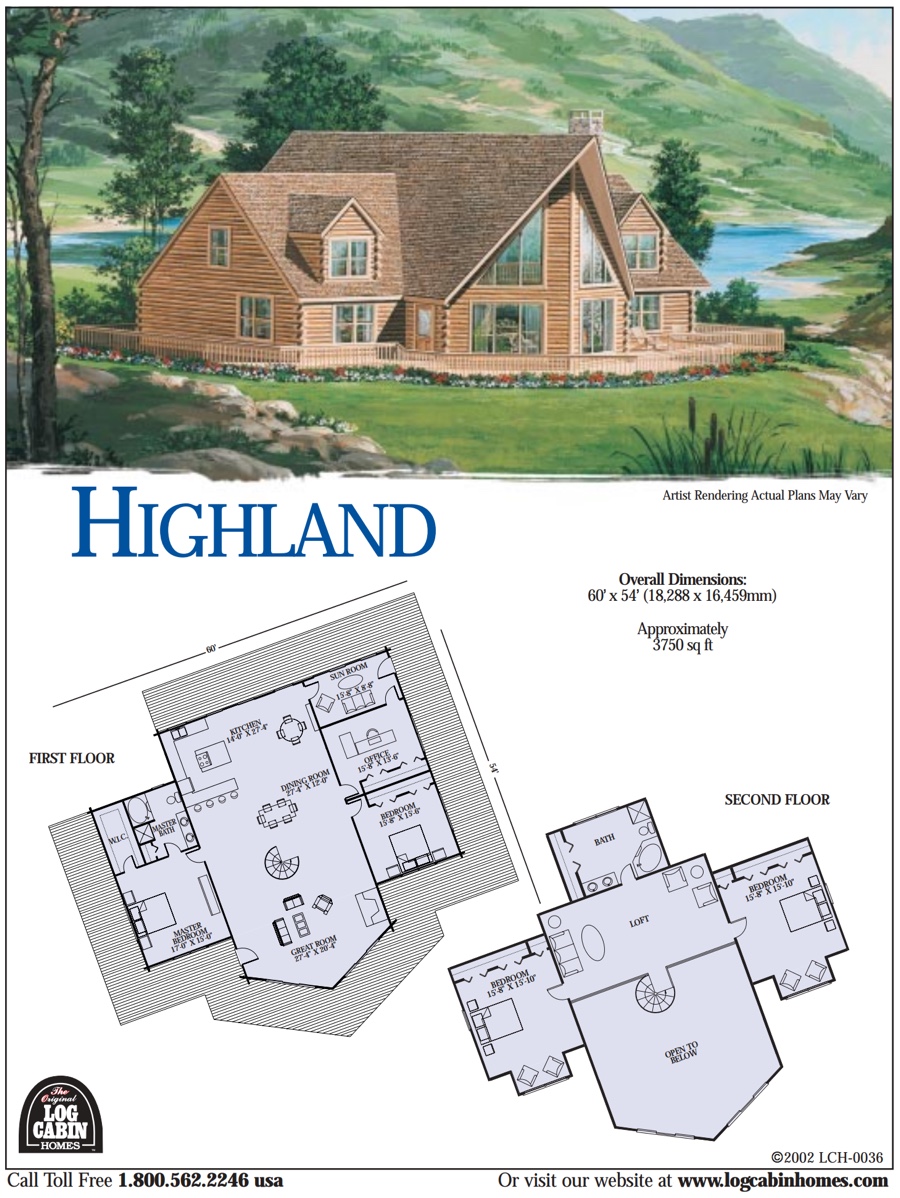

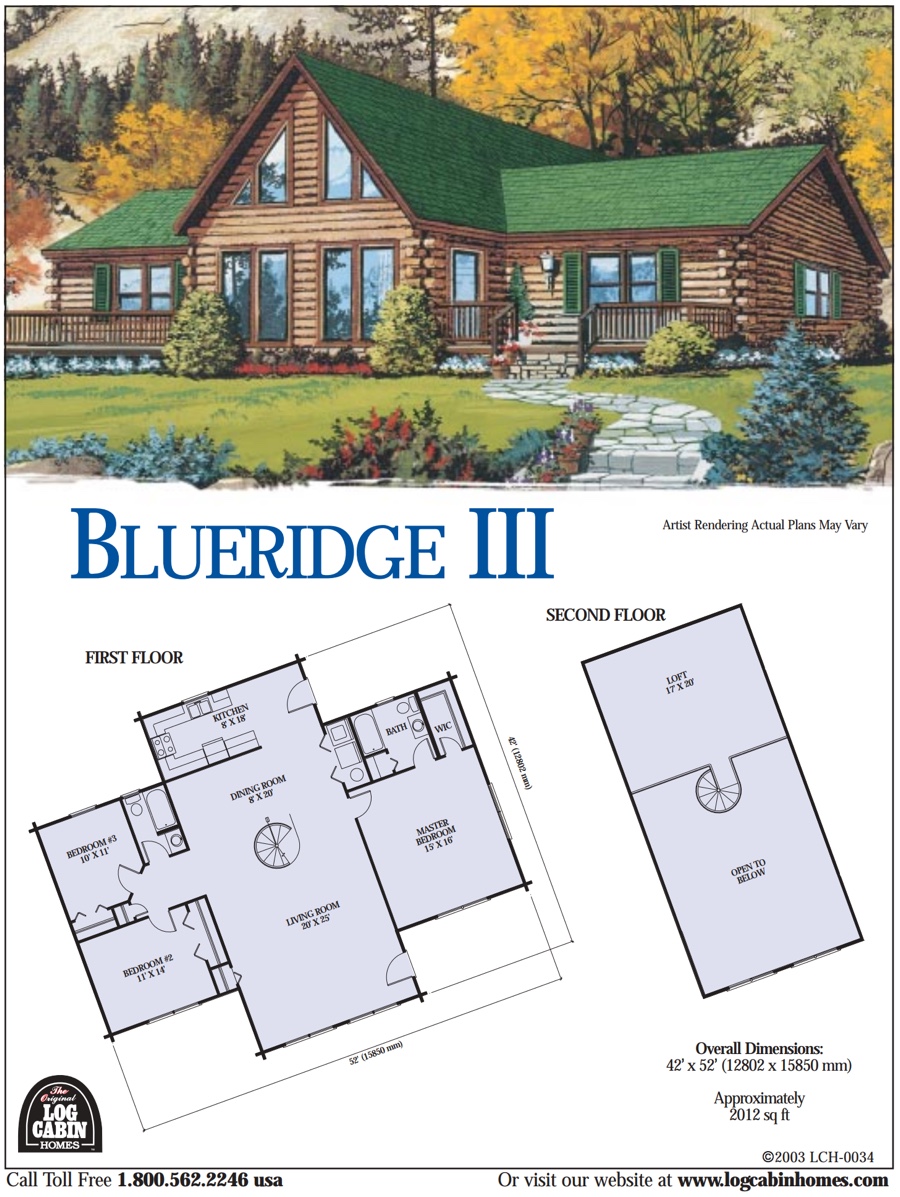

Before you embark on your saving journey, define your vision for the log cabin home. Consider factors such as location, size, amenities, and any special features you desire. Having a clear picture of your goals will help you stay focused and motivated throughout the saving process.

Evaluate your current financial situation and determine how much you can realistically save each month towards your log cabin fund. Consider your income, expenses, and any existing savings or investments. Establishing a budget will provide a roadmap for achieving your savings goal.

Evaluate your current financial situation and determine how much you can realistically save each month towards your log cabin fund. Consider your income, expenses, and any existing savings or investments. Establishing a budget will provide a roadmap for achieving your savings goal.

Identify areas where you can trim unnecessary expenses to free up more money for savings. This might involve cutting back on dining out, entertaining costs, or subscription services. Every dollar save can bring you closer to your log cabin dream.

Explore opportunities to boost your income, whether through side hustles, freelance work, or seeking a higher-paying job. Consider monetizing your hobbies or skills to generate additional funds specifically earmarked for your log cabin fund.

Set up automatic transfers from your checking account to a dedicated savings account for your log cabin fund. Automating your savings ensures consistency and removes the temptation to spend the money elsewhere. Treat your log cabin savings as a non-negotiable expense.

Maximize the growth potential of your savings by parking them in a high-yield savings account or low-risk investment account. Research different financial institutions to find the best interest rates or investment options that align with your risk tolerance and timeline for purchasing your log cabin.

Track your savings progress regularly to stay on course towards your goal. Set milestones along the way and celebrate each milestone achieved. Periodically reassess your budget and financial strategies to ensure you’re making optimal progress towards your log cabin dream.

Explore alternative financing options such as personal loans, home equity loans, or crowdfunding platforms to supplement your savings for the log cabin purchase. Be sure to weigh the pros and cons of each option and consult with financial experts if needed.

Research the cost of building or purchasing a log cabin home in your desired location. Factor in expenses such as laid acquisition, construction materials, permits, and labor costs. Obtain quotes from reputable log cabin builders or real estate agents to get a realistic estimate of your total investment.

Saving up for a log cabin home is a marathon, not a sprint. Stay patient and stay focused on your long-term goal, even if setbacks or unexpected expenses arise. Be open to adjusting your timeline or approach as needed, but never lose sight of the dream that inspired you to start saving in the first place.

Saving up for a log cabin home requires discipline, dedication, and careful financial planning. By setting clear goals, creating a budge, cutting expenses, and staying committed to your saving plan, you can turn your dream of owning a log cabin retreat into a reality. With patience and perseverance, your cozy woodland getaway awaits. Start saving today and take the first step towards making your log cabin dream come true.

Posted Date February 19, 2024

Written By Hannah Garciga